Bookkeeping

5 Essential Nonprofit Financial Documents

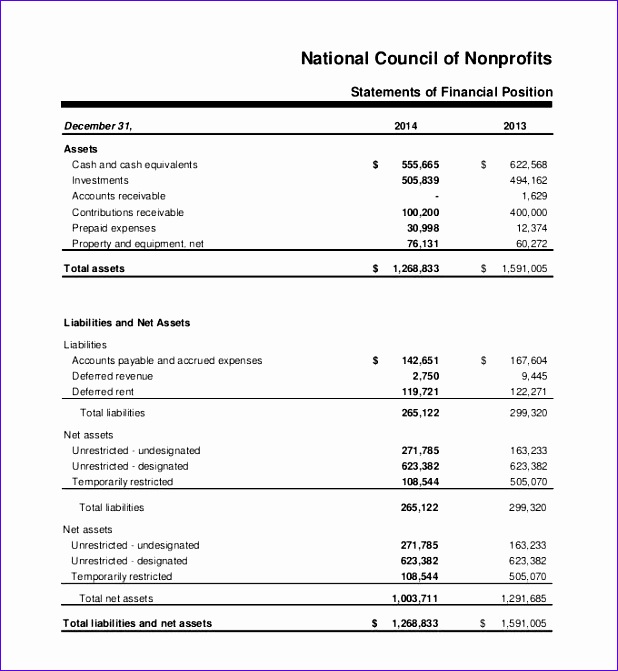

Examples include the need for accurate financial reporting and a thorough nonprofit audit to ensure the organization’s financial statements are reliable and transparent. Keep in mind, though, that this report is more accurate and helpful if your organization uses an accrual method of accounting, rather than the cash method. Accrual accounting allows nonprofits to record revenue when earned and expenses when incurred rather than when the money actually enters or leaves the account (which is how cash accounting works). As a result, it can provide a more accurate statement about when financial changes occurred, and a more accurate nonprofit balance sheet. Many nonprofits will also share these financial statements with their donors, and use them in their annual reports.

Free Course: Understanding Financial Statements

While tax-exempt status might be determined by the IRS and federal law, nonprofit status is determined by state law. Because of this, the IRS requires that you obtain nonprofit status from your state before applying for tax-exempt status. For the most part, nonprofits can apply to the IRS to become exempt from federal taxes under Section 501.

- Financial analysis can be done by calculating financial ratios to determine the financial gain of the organization.

- The Statement of Financial Position gives you a snapshot of your financial health by revealing the underlying value of what your organization owns.

- Return to the Internal Reports Introduction page using the link below for greater detail on how to read various reports as well as recommended formatting.

- They help ensure that the organization is following accounting standards and reporting requirements.

- Understanding net assets involves a clear grasp of the nonprofit balance sheet, also known as a statement of financial position.

Statement of cash flows

These activities involve the acquisition and disposal of long-term assets, such as property, equipment, and investments. Nonprofits may engage in investing activities to generate income or to support their mission. For example, a nonprofit may invest in stocks or bonds to earn dividends or interest that can be used to fund programs and services. It’s important for nonprofits to carefully manage their investing activities to ensure they align with their financial goals and risk tolerance. By monitoring and evaluating the performance of their investments, nonprofits can make informed decisions to optimize their financial resources.

Streamline your accounting and save time

Wellington Zoo’s annual report uses its audited financial statements (from page 45) to show the organization’s financial health. This organization also states that the board and management stand behind these financial statements and they include pictures of their Board Chairperson and Chief Executive Officer. Nonprofits must include a balance sheet when applying for federal tax exemption and filing taxes. Balance sheets share your nonprofit’s liquidity and how much cash is available and can be an excellent way to track how your organization’s financial status has changed in past years. It also helps nonprofits measure their financial performance against their charitable goals.

Foundations require nonprofits to provide financial statements when they apply for grants. Major donors also may want to see financial statements before giving a significant gift. When a nonprofit shares more about its financial health, foundations and sponsors see that the nonprofit is financially viable and feel safer giving. In this article, we’ll explain more about each financial statement, why and the difference between assets and liabilities when nonprofits need financial statements, and share examples of how organizations have used them in their annual reports. Sharing how your nonprofit’s financial status has changed gives board members, donors, and foundations a better overview of the health of your nonprofit. Your size, your activities, and your funding sources will all determine which reports you need to run your business effectively.

What is the Statement of Financial Position?

Knowing the right forms and documents to claim each credit and deduction is daunting. Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Taxes are incredibly complex, so we may not have been able to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Compared with Wellington Zoo, the financial statements used in this report are easier to follow and provide fewer details. The primary reason for this is this method lets nonprofits record revenue when it’s earned. The first and most apparent liabilities are your organization’s operational costs. Your balance sheet will split assets by current assets, fixed assets, and others.

These funds are subject to restrictions and can only be used for the specified purposes. It is important for nonprofits to track and report on both unrestricted and restricted net assets to ensure transparency and accountability. The Statement of Financial Position, also known as the balance sheet, provides a snapshot of an organization’s financial health at a specific point in time. Assets represent what the organization owns, such as cash, investments, and property. Liabilities represent what the organization owes, such as loans and accounts payable. Net assets, also known as equity or fund balance, represent the organization’s total assets minus its liabilities.

Restricted net assets are donations that have certain terms and restrictions attached, have special accounting procedures, and must be kept separate from other net assets. Nonprofit-friendly accounting software shouldn’t just allow you to create professional-looking budgets. They should also let you track how your income and spending for the year compare to your budget goals. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support. Examples include outstanding bills, accrued expenses, payroll and payroll tax liabilities, lines of credit, and short-term loans. You’ll find your organization’s liabilities organized by current and non-current liabilities on the Statement of Financial Position.

The Three Bucket Framework beats the Checkbook Framework any day of the week. We’ve created an example below to show you what a nonprofit statement might look like. Return to the Internal Reports Introduction page using the link below for greater detail on how to read various reports as well as recommended formatting. For more information about how to create a budget, check out the National Council of Nonprofits guide to Budgeting for Nonprofits.